6. How can an employee part-pay a company car's cost?

2:02

"How can an employee part-pay a company car's cost?"

When a person's agreed to pay for part of the purchase cost of a company car, you'll need to update the company vehicle benefit.

To update a vehicle benefit if a person's agreed to pay for part of a company car's purchase cost:

- First, select the pay batch on: MenuPay batches

- Then tap: SettingsPay batch settings

- Then scroll to the bottom and look for the "Repeat payables" heading.

- And tap the company vehicle benefit you'd like to store an "Employee payment towards car" for.

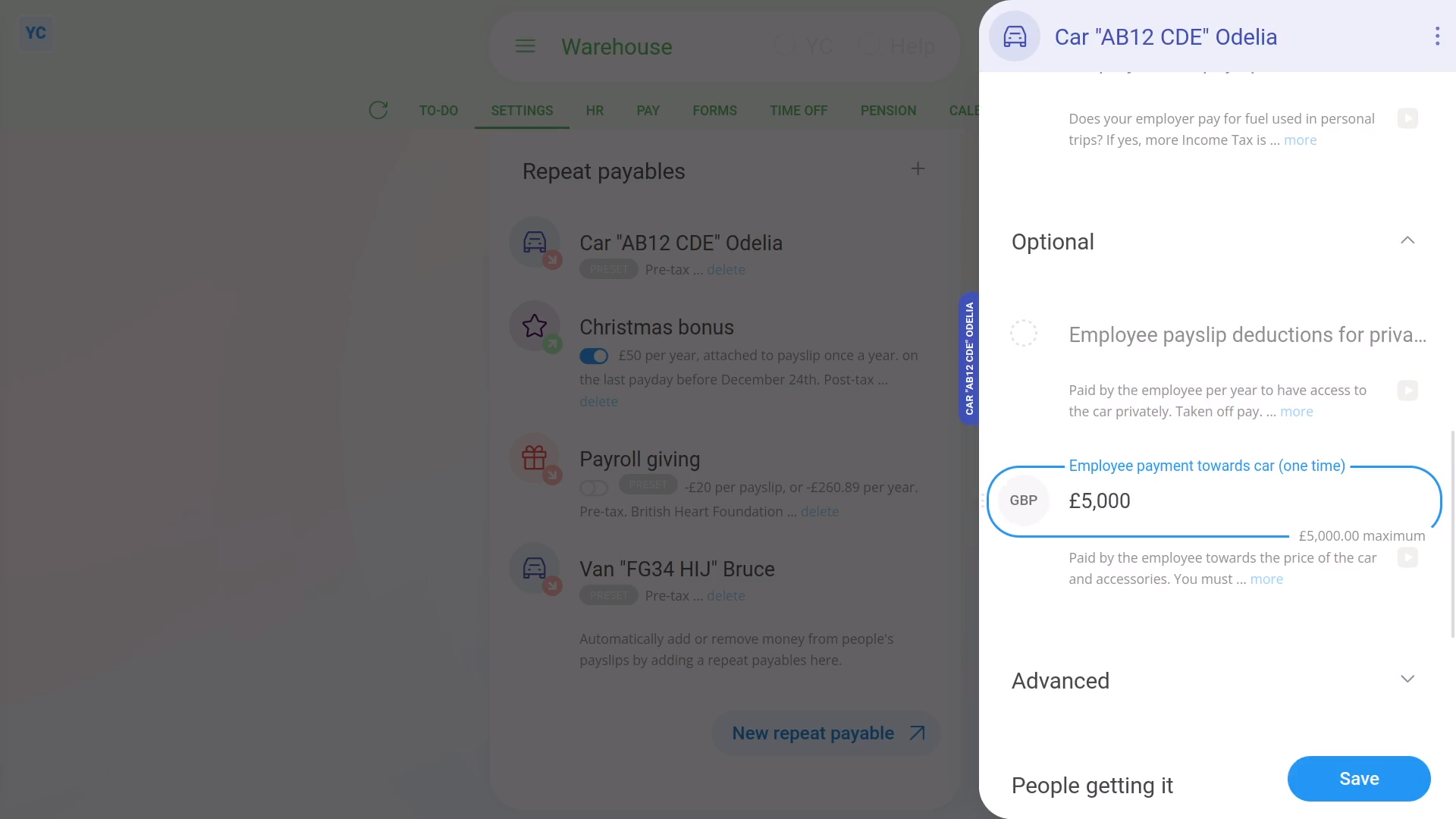

- Then scroll down and expand the "Optional" heading.

- Then in Employee payment towards car, enter how much the employee is paying, one-time.

- The amount of the one-time payment isn't automatically deducted by 1st Money from any payslip.

- Read the note which explains how you must separately arrange the payment.

- Next, tap: Save

- To see how the "Employee payment towards car" affects people's payslips, tap the company vehicle benefit again.

- Next, scroll down, then tap the person.

- Then hover your mouse over the vehicle benefit, and tap the "See on payslip" button:

- And you'll see the vehicle benefit showing under: "Benefits-in-kind ... company arranged"

- And finally, when you hover your mouse over the benefit amount, you'll see the breakdown. In the breakdown the "per year" amount is now lower because of the: "Employee payment towards car"

Keep in mind that:

- The "Employee payment towards car" option doesn't show if the "Vehicle type" is set to: "Van"

- Also, the money deducted, to pay for part of the purchase cost of a company car is sometimes also known as: "capital contributions"

And that's it! That's all you need to do, if a person's agreed to pay for part of a company car's purchase cost.

Was this page helpful?