4. How do I update a vehicle benefit payslip deduction?

1:54

"How do I update a vehicle benefit payslip deduction?"

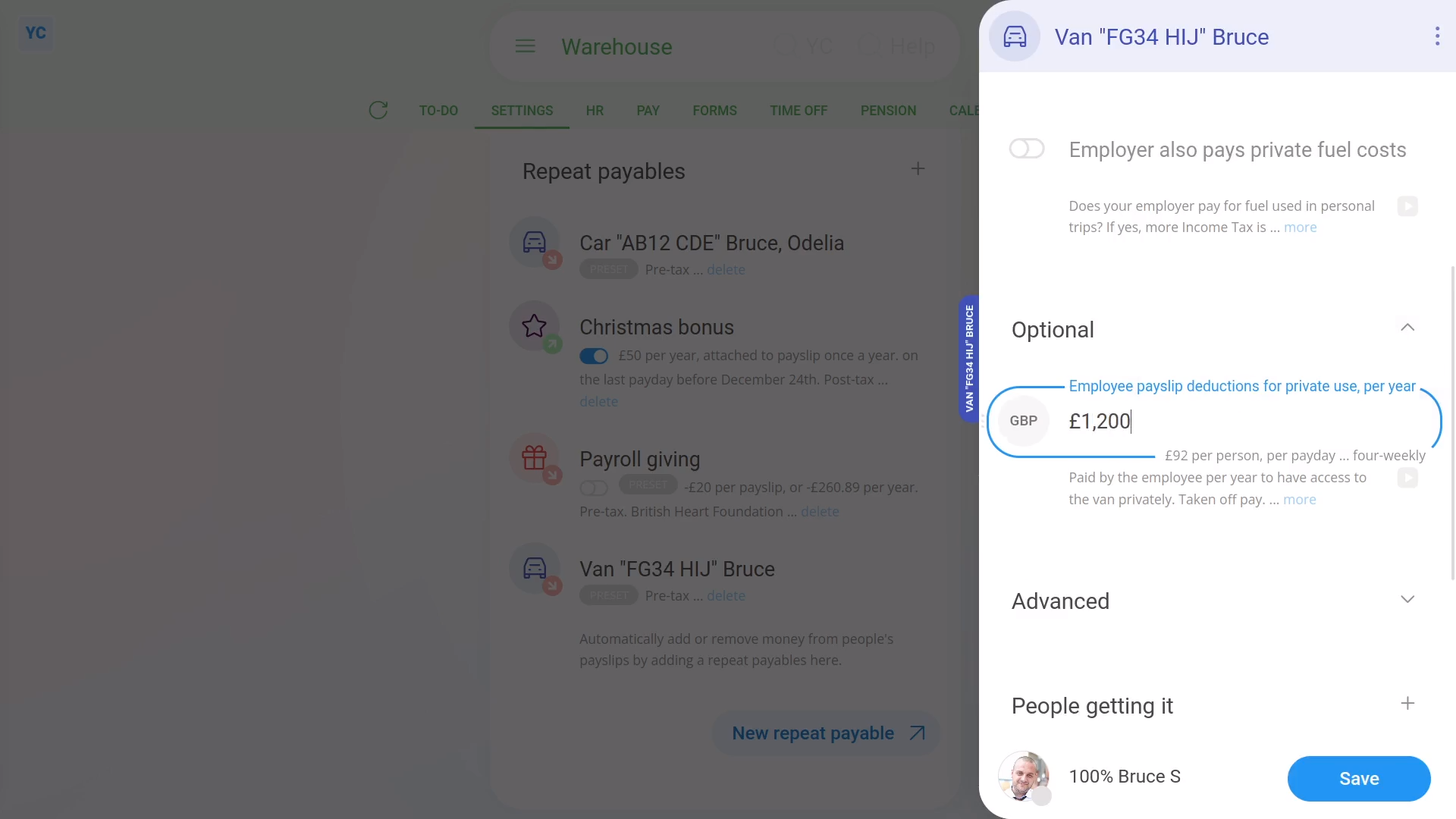

When a company vehicle is used for private purposes, and the person's agreed to have money automatically deducted, you'll need to update the company vehicle benefit.

To set up a payslip deduction for a person's private use of a company vehicle:

- First, select the pay batch on: MenuPay batches

- Then tap: SettingsPay batch settings

- Then scroll to the bottom and look for the "Repeat payables" heading.

- And tap the company vehicle benefit you'd like to set up a "Vehicle private use" deduction for.

- Then scroll down and expand the "Optional" heading.

- Then in Employee payslip deductions for private use, enter how much is to be deducted, every year, to drive the vehicle privately.

- Next, tap Save, and the "Vehicle private use" deduction is added to the payslips of the people using the vehicle.

- To see the "Vehicle private use" deduction on the people's payslips, tap the company vehicle benefit again.

- Next, scroll down, then tap the person.

- Then hover your mouse over the vehicle benefit, and tap the "See on payslip" button:

- And you'll see the "Vehicle private use" showing under: "Post-tax withholdings"

- And finally, when you hover your mouse over the benefit amount, you'll see a breakdown of the "Vehicle private use" calculation.

Keep in mind that:

- The change of adding or removing "Vehicle private use" shows up on each person's next un-filed payslip.

- And it won't affect any of their previously filed payslips.

And that's it! That's everything you need to know about deducting for private use of a company vehicle.

Was this page helpful?

3. How do I add or remove people from a company vehicle benefit5. How do I do a vehicle benefit to cover private fuel use