5. How do I do a vehicle benefit to cover private fuel use?

2:03

"How do I do a vehicle benefit to cover private fuel use?"

When a company vehicle is used for private purposes, and the fuel is covered by the company, you'll need to update the company vehicle benefit.

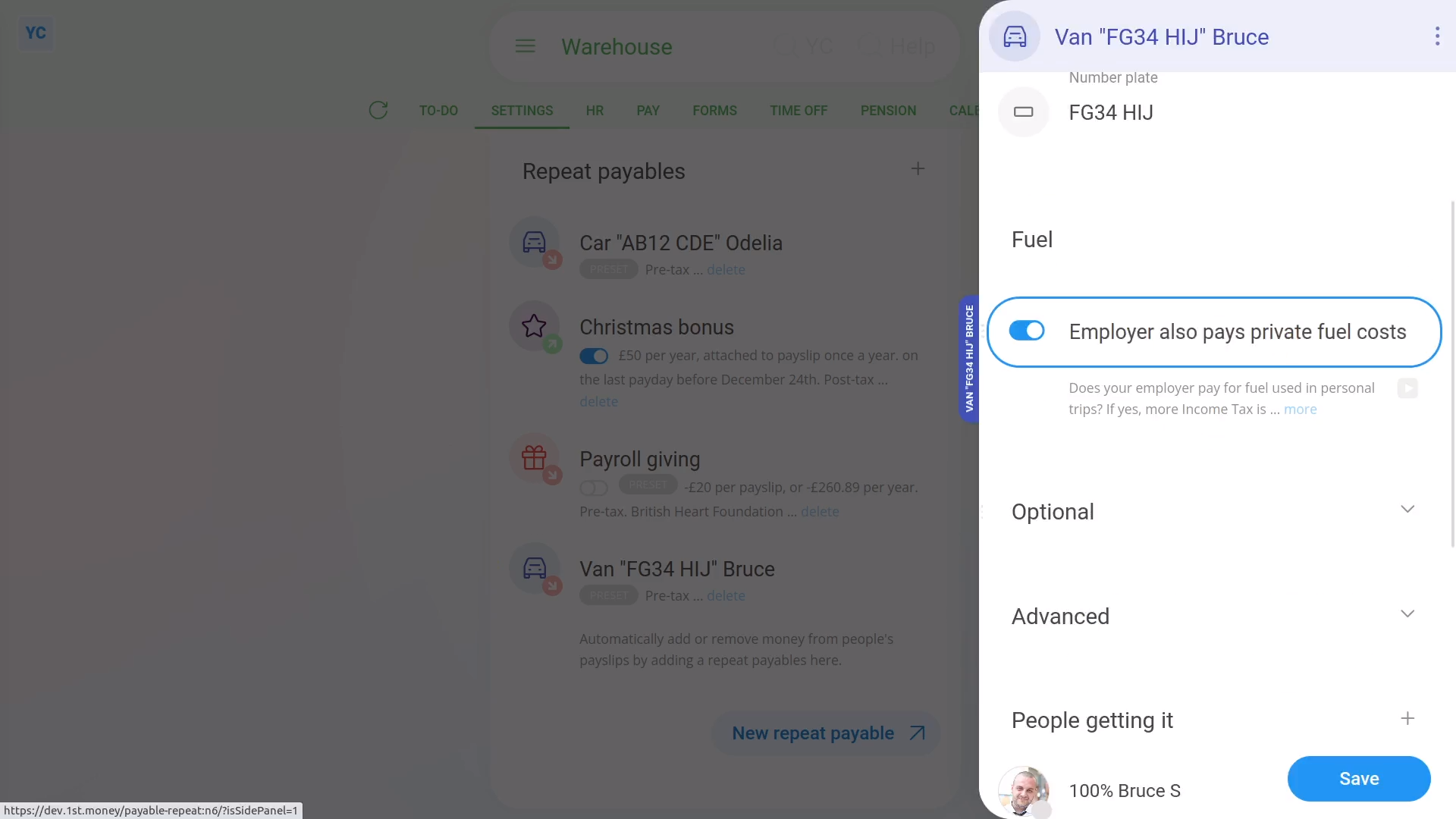

To update a pay batch's vehicle benefit to include private fuel use:

- First, select the pay batch on: MenuPay batches

- Then tap: SettingsPay batch settings

- Then scroll to the bottom and look for the "Repeat payables" heading.

- And tap the company vehicle benefit you'd like to include private fuel use for.

- Then scroll down to the "Fuel" heading.

- And turn on: Employer also pays private fuel costs

- Next, tap Save, and the private fuel use is added to the payslips of the people using the vehicle.

- To see the private fuel use on the people's payslips, tap the company vehicle benefit again.

- Then scroll down, and expand the "Advanced" heading.

- And you'll see the yearly private fuel "Benefit-in-kind" cash equivalent.

- And you'll also see that it's been added to the vehicle benefit's: "Total yearly cash equivalent"

- Next, scroll down, then tap the person.

- Then hover your mouse over the vehicle benefit, and tap the "See on payslip" button:

- And you'll see the vehicle benefit showing under: "Benefits-in-kind ... company arranged"

- And finally, when you hover your mouse over the benefit amount, you'll see a breakdown of the calculation which now includes the private fuel use amount.

Keep in mind that:

- The change of adding or removing private fuel use shows up on each person's next un-filed payslip.

- And it won't affect any of their previously filed payslips.

And that's it! That's all you need to do, to update a vehicle benefit if your company covers a person's cost of fuel.

Was this page helpful?

4. How do I update a vehicle benefit payslip deduction6. How can an employee part-pay a company car's cost