2. If a company buys an asset from an employee, how's it recorded?

1:49

"If a company buys an asset from an employee, how's it recorded?"

When the company buys an asset from an employee, the buying price of the asset is tax-free.

To record buying an asset from an employee:

- First, tap: MenuExpense claim

- Select the person who the company is buying the asset from.

- Then tap: Once only tax-free benefit

- You can attach an image, like a sale agreement, or tap: Skip image

- Type in how much the asset is worth when you're buying it from the employee, and tap: Next

- Then for "Requesting because", type a short description of the asset the company's buying, and tap: Next

- And because it's a payroll admin who's entering it, the expense is automatically approved.

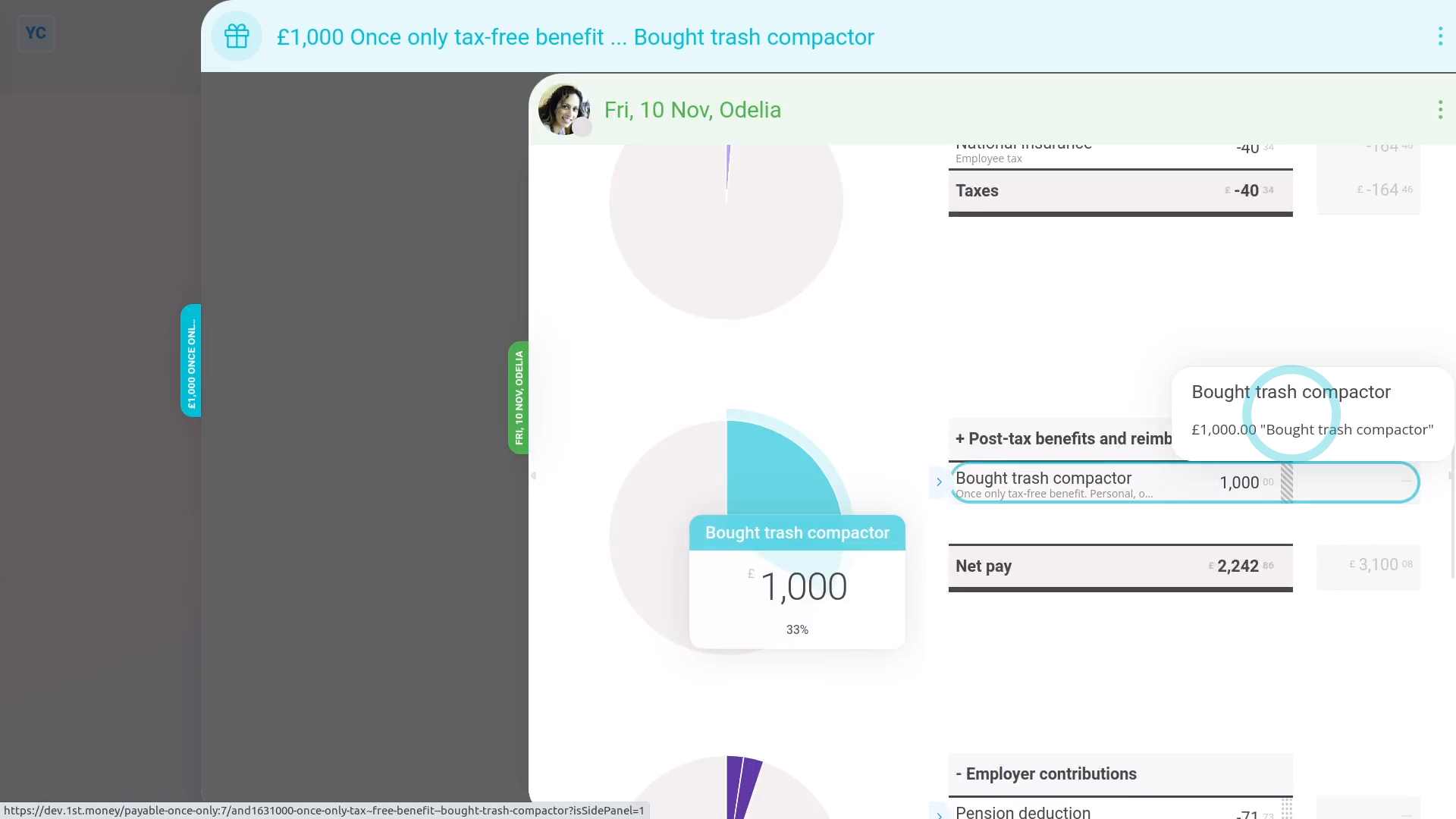

- Now, to see how it shows up on the person's payslip, scroll down and tap: See on payslip

- And when you hover your mouse over the "Once only tax-free benefit" amount, you'll see the details.

- And finally, you'll know that the asset's value is being correctly paid to the employee, free of tax.

Keep in mind that:

- If the company buys an asset from an employee for more than it's market value, the amount over the market value is taxable.

- To record it, still do the steps above, to record the amount up to the market value.

- And then also add a "Once only taxable benefit" expense for the amount over the market value.

And that's it! That's everything you need to know about buying an asset from an employee!

Was this page helpful?